Recently, the wine industry reporter was exclusively informed of the 2017 bottled still wine global enterprise and brand TOP25 list (2018 data will be released in mid-2019), the list is organized by the authority of the International Wine and Spirits Research Institute (IWSR) provide.

According to the list data, in the past five years, E & J Gallo’s bottled still wine sales have been rising, ranking first among global wine companies, and Changyu ranked 21st, the only one in the TOP25 list. Domestic wine companies. The Franzia brand from The Wine Group won the brand list with 280 million bottles, while the old world wine country brands only accounted for seven seats.

Jialu sales rank first in the world, followed by constellations

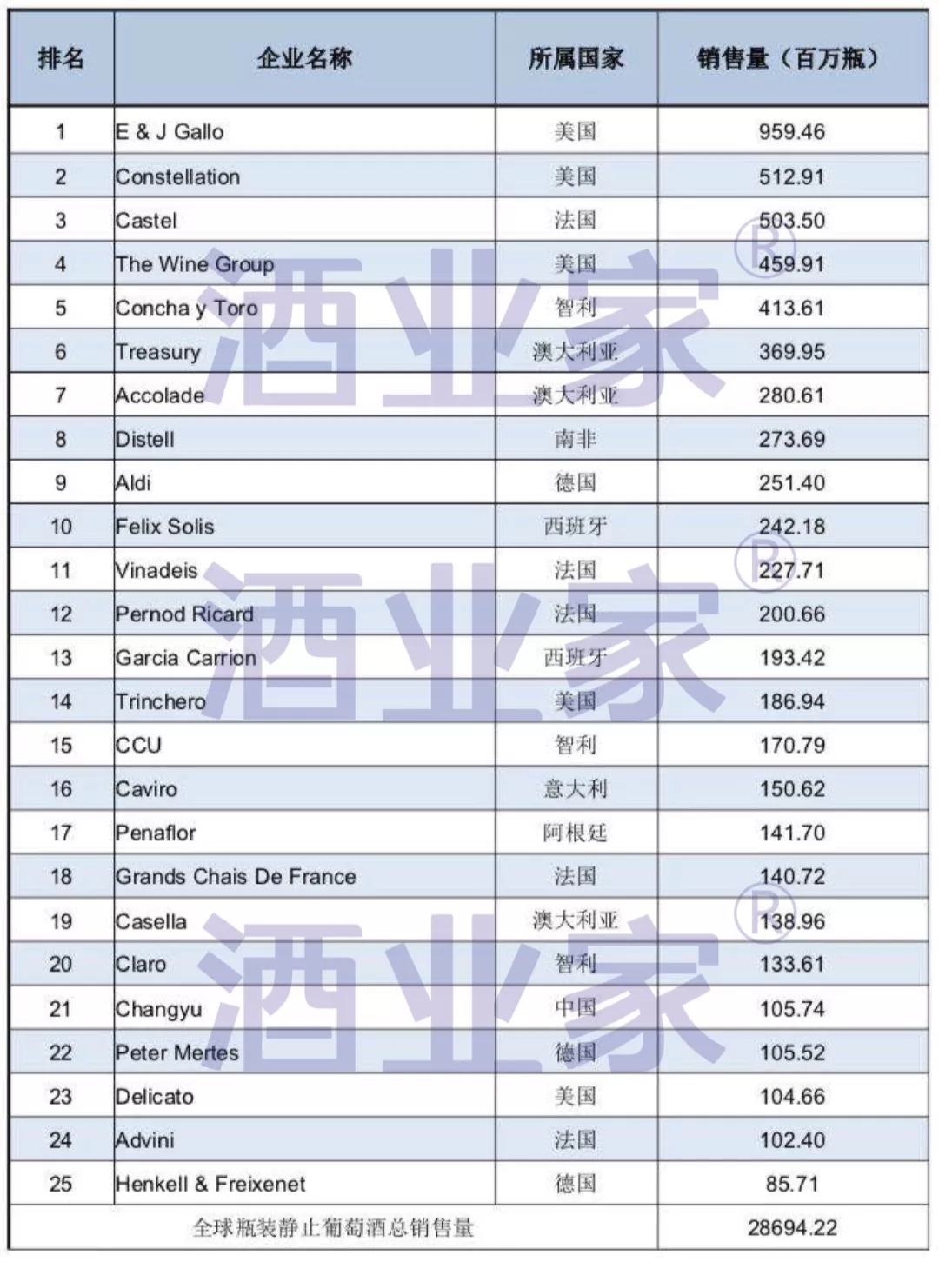

The list shows that in the category of bottled still wines, Jialu Group ranks first in the world with sales of 959 million bottles. Jialu is one of the few wine companies that have maintained a steady upward trend in the static wine category in recent years, an increase of about 12% compared with the 856 million bottles in 2013.

Global bottled still wine sales list (Enterprise TOP25)

Constellation took second place with 513 million bottles, and France’s Castel followed closely with a slight gap. However, according to data disclosed by IWSR, Cassie Lear is in retail sales by Treasury, Concha y Toro, Accolade and Pernod. Ricard) beyond. Zhang Qiang, general manager of Guangzhou Shangdu Wine Industry, believes that the top ranking of American wine companies in the world is due to the growth of brand wines.

Wine industry reporters noted that Henkell & Freixenet, the world’s largest sparkling wine group, also performed well in the static wine sector, ranking 25th with 85.71 million bottles. Its stationary wine brand, I Heart, has grown rapidly from 1.40 million bottles in 2013 to 9.52 million bottles in 2017, a 6.8-fold increase. Mr. Gu Yuping, representative of Hankai & Fissnet China, told the wine industry reporter that “the future will be in the field of static wine”.

In terms of the total amount of global still wines, after experiencing the peak sales of 28.932 billion bottles of still wine in 2013, it plummeted to 28.356 billion bottles in 2014. Although it has been increasing at a slow rate in the following years, the 28.694 billion bottles in 2017 have not recovered to the level of 2013. Due to the decline in global wine production in 2017 and the impact of the economic environment, it is difficult to achieve growth in 2017 based on 2017.

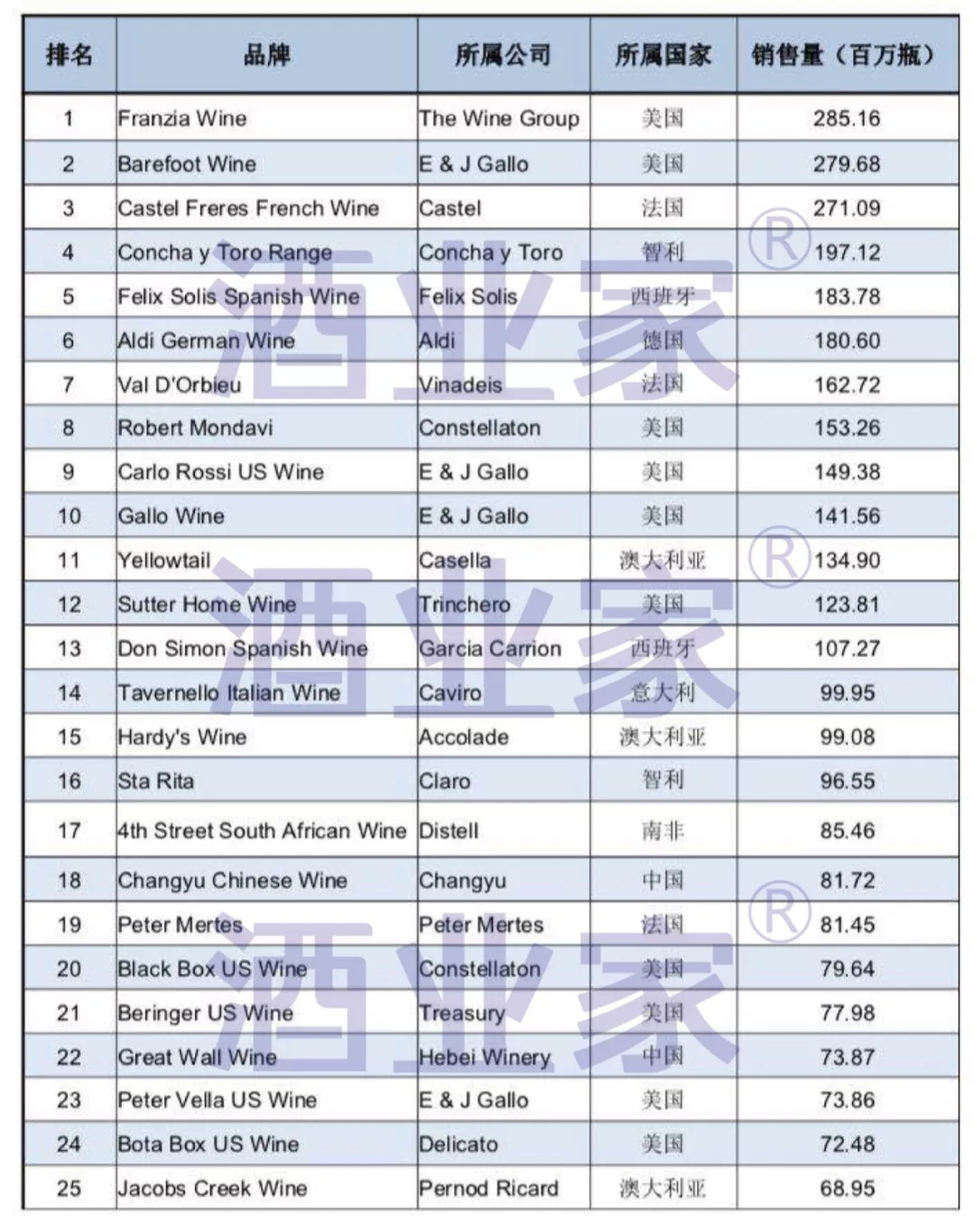

Feng Shiya returns to the world’s best-selling brand, and the old world national brands only account for 7 seats.

After experiencing the lows of 2015 and 2016, American Wind Asia finally returned to the top of the TOP25 brand with sales of 285 million bottles. The sales of Castel Freres dropped from 310 million bottles in 2015 to 271 million bottles in 2017, and fell to third place after winning the first two years.

Global bottled still wine sales list (brand TOP25)

(Image source network, if there is any infringement, please contact this site)

Although the brands of Fengshiya, Cassidy Brothers and Barefoot have been stable in the top three in 2013-2017, Belfort has not been at the top of the list compared to the former two, but its sales volume Has been steadily improving.

The domestic wine brands Zhang Yu and the Great Wall are on the list, ranking 18th and 22nd respectively. Both sales have declined since 2013. Xi Kang, vice chairman of the China Wine Association Alliance, believes that the decline in sales of some domestic wines indicates that the Chinese market is maturing and consumers are increasing their choice of wine.

Will the fragmentation pattern of the global wine market change?

It is worth noting that TOP25 companies do not account for 23% of the total market for the sale of bottled still wines. Similarly, the top 25 brands have a total sales volume of less than 12%.

Gu Yuping believes that the diversification of wine leads to the sales of the entire market will not be concentrated in a few leading companies or brands. Xi Kang and Zhang Qiang also hold the same view: wine belongs to agricultural products. Due to the influence of varieties and terroirs, the difference is large, which increases the difficulty of standardization, and standardization is an important way to form a brand. In the consumption scene, wine is more concentrated in the live drinking channel, while the global dining styles vary in style and require a wide variety of wines. Zhang Qiang also mentioned that each consumer’s preferences are different, especially mature consumers are more inclined to try a variety of wines.

On the brand list, the main market of most brands is in the country of the brand, and the major markets and major export markets of a very small number of brands are abroad, such as the Penfolds of the rich group known to the Chinese, its Major markets and major export markets are concentrated in China. Fuyu’s predecessor was affiliated with Foster’s, the global wine giant. In May 2011, Fuyu was independent and listed in Australia.

Zhang Qiang told the wine industry reporter that after the divestiture of Fu Shi from Fu Shi Da, the emerging markets were seriously affected by the US market, but the sudden rise of the Chinese market brought huge growth to the rich. This shows that the core market’s advantages in building and maintaining and the development of emerging markets can change the ranking of companies and brands. At the same time, the impact of the company’s business strategy, such as brand promotion, product and channel innovation, and the focus and accumulation of marketing will also affect the changes in the list. The continued promotion of the Australian Wine Authority for many years has had a significant impact on the impact of Australian wine brands in the Chinese market.

“The two big markets of China and India will change the ranking of the global list in 10 years. Once the liquor company is deeply involved in the wine, it will change a lot.” Gu Yuping made a pre-judgment in an interview with the wine industry reporter.